15 best payroll software solutions for small business

Introduction

As a small or medium-sized business (SMB), managing payroll can be a time-consuming and error-prone task. However, with the right payroll software solution, you can streamline your HR and payroll processes, saving time and reducing the risk of mistakes. In this article, we will explore the top 15 payroll software solutions for Small Business highlighting their key features, pricing, pros, and cons. Whether you are looking for scalability, customization, cost-effectiveness, user-friendliness, or compliance features, there is a payroll software solution on this list that can meet your needs.

The role of payroll software in SMB efficiency

Implementing payroll software can significantly impact the efficiency of your HR and finance operations. By automating payroll processes, you can reduce the time spent on manual calculations and data entry. Payroll software also plays a crucial role in ensuring compliance with tax regulations and labor laws, reducing the risk of penalties and legal issues. With accurate and timely payroll processing, you can enhance employee satisfaction and maintain a positive work environment.

Key selection criteria for payroll software

Before diving into the top payroll software solutions, let's discuss some key criteria to consider when selecting the right software for your SMB.

1. Scalability and customization

As your business grows, you need a payroll software solution that can scale with your needs. Look for software that can handle an increasing number of employees and adapt to your changing payroll requirements. Additionally, customizable features allow you to tailor the software to your specific business needs, ensuring a seamless integration with your existing HR and accounting systems.

2. Cost-effectiveness

Affordability is a crucial factor for SMBs. Consider the pricing structure of each software solution, including any additional fees for features or support. Some software providers offer tiered pricing plans based on the number of employees or the level of functionality you require. Compare the costs and benefits to find the best fit for your budget.

3. User friendliness and support

A user-friendly interface and intuitive navigation are essential for the smooth adoption and efficient use of payroll software. Look for solutions that offer comprehensive onboarding and training materials to help you and your team get up to speed quickly. Additionally, take into account the level of customer service that the software provider offers because you might require assistance with troubleshooting or resolving any issues that arise.

4. Integration capabilities

Your payroll software should integrate seamlessly with your existing HR, accounting, and time-tracking systems. Integration eliminates the need for manual data entry, reducing the risk of errors and saving time. Before making a decision, ensure that the software can integrate with your preferred systems or offers integrations with commonly used software in your industry.

5. Compliance features

Compliance with tax regulations and labor laws is crucial for any business. Payroll software should have built-in features to handle tax calculations, deductions, and reporting accurately. Look for solutions that stay up-to-date with the latest legal requirements and provide automated updates to ensure compliance.

Now that we have discussed the key selection criteria, let's dive into the top 15 payroll software solutions for SMBs. We will explore their features, pricing, pros, and cons to help you make an informed decision.

1. QuickBooks Payroll

Introduction

QuickBooks Payroll is a popular choice among SMBs due to its seamless integration with QuickBooks accounting software. It offers comprehensive payroll features, including automated calculations, tax filing, and direct deposit capabilities.

Key features

- Automated payroll calculations and tax deductions

- Tax filing and compliance assistance

- Direct deposit and electronic pay stubs

- Integration with QuickBooks accounting software

- Employee self-service portal for accessing pay stubs and tax documents

Pricing

QuickBooks Payroll offers three pricing plans:

- Basic: Starting at $45 per month, plus $4 per employee per month

- Enhanced: Starting at $75 per month, plus $8 per employee per month

- Full-Service: Starting at $125 per month, plus $10 per employee per month

Pros

- Seamless integration with QuickBooks accounting software

- user-friendly interface and straightforward setup process

- Automated tax calculations and compliance features

- Direct deposit and electronic pay stubs for employees

Cons

- Higher pricing compared to some competitors

- Limited customization options for payroll and reporting

Get a free quote

Ready to simplify your payroll process with QuickBooks Payroll? Click below to get a personalized quote and see how it can streamline your payroll tasks.

Learn more about QuickBooks Payroll

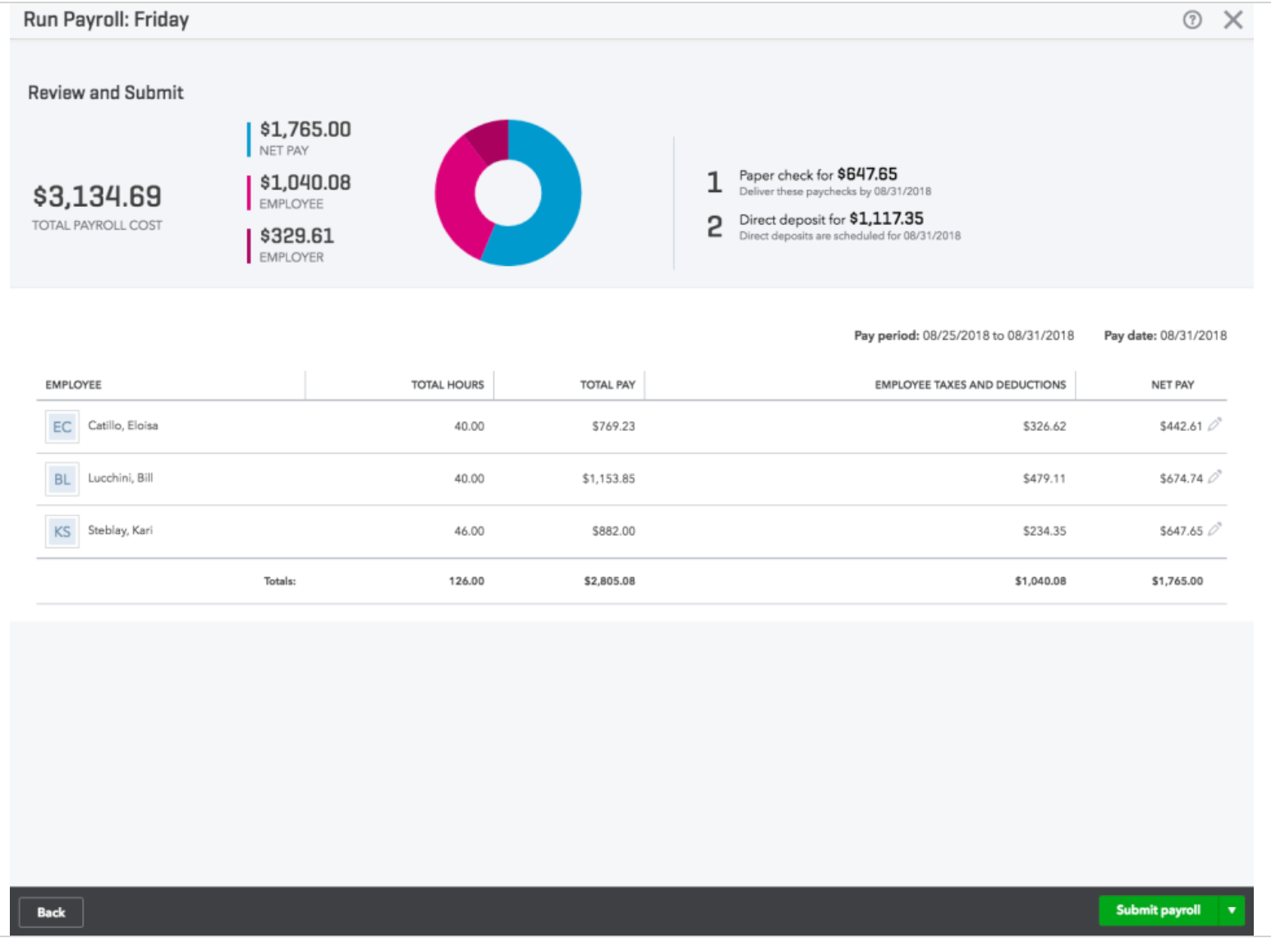

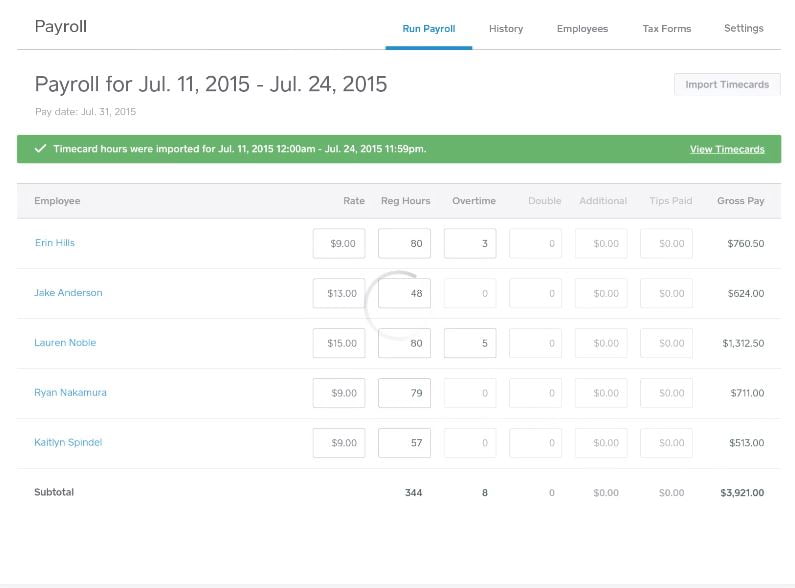

Image Gallery

2. Gusto

Introduction

Gusto is a comprehensive payroll software solution that offers a range of HR and benefits features in addition to payroll processing. It is known for its user-friendly interface and excellent customer support.

Key features

- Automated payroll calculations and tax filings

- Employee self-service portal with access to pay stubs and tax documents

- Integration with popular accounting and time-tracking software

- HR features, including onboarding, employee benefits, and time-off tracking

- Compliance assistance and year-end tax form generation

Pricing

Gusto offers three pricing plans:

- Core: Starting at $39 per month, plus $6 per employee per month

- Complete: Starting at $39 per month, plus $12 per employee per month

- Concierge: Starting at $149 per month, plus $12 per employee per month

Pros

- user-friendly interface and easy setup process

- Comprehensive HR features in addition to payroll processing

- Integration with popular accounting and time-tracking software

- Excellent customer support and resources

Cons

- Limited customization options for payroll and reporting

- Some advanced features are only available on higher-priced plans.

Get a free quote

Discover how Gusto can transform your payroll and HR processes. Get your free quote today and start enjoying a more efficient payroll system!

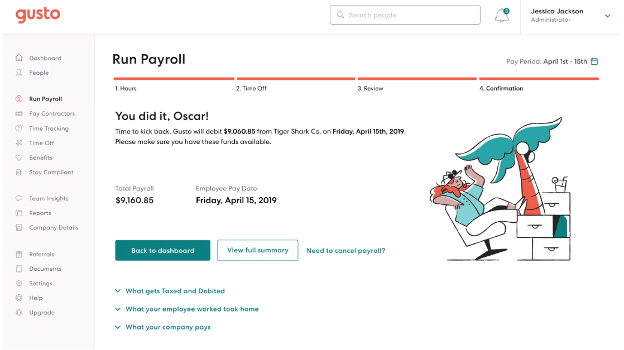

Learn more about Gusto

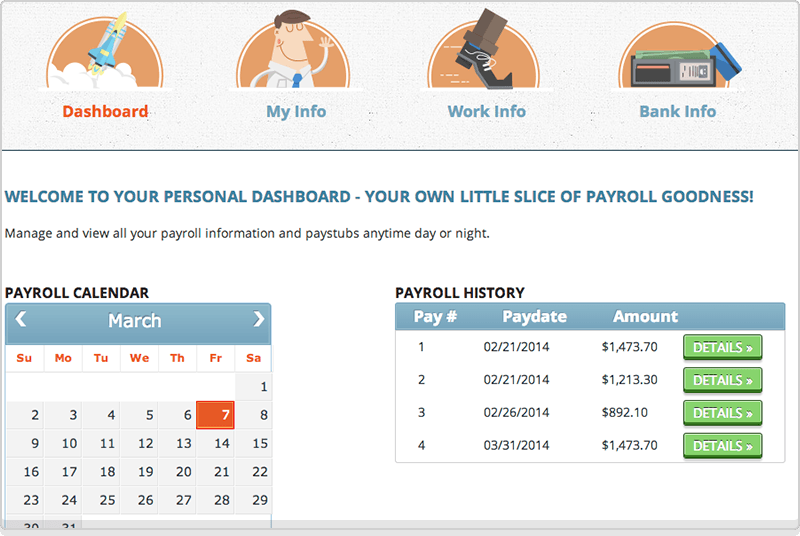

Image Gallery

3. ADP Workforce Now

Introduction

ADP Workforce Now is a robust payroll and HR software solution designed for mid-sized businesses. It offers a wide range of features, including payroll processing, benefits administration, and talent management.

Key features

- Payroll processing with automated calculations and tax filings

- Benefits administration and open enrollment management

- Time and attendance tracking with customizable rules and policies

- Talent management features, including performance reviews and goal tracking

- Compliance assistance and reporting tools

Pricing

Pricing for the ADP workforce Now, it is not publicly available. Contact ADP for a custom quote based on your business requirements.

Pros

- Robust payroll and HR features on a single platform

- A scalable solution suitable for mid-sized businesses

- Comprehensive compliance assistance and reporting tools

- Integration options with other ADP products and third-party software

Cons

- Pricing information is not readily available.

- Steeper learning curve compared to some other software solutions

Get a free quote

Interested in a robust payroll solution for your mid-sized business? Contact ADP now for a custom quote tailored to your unique needs.

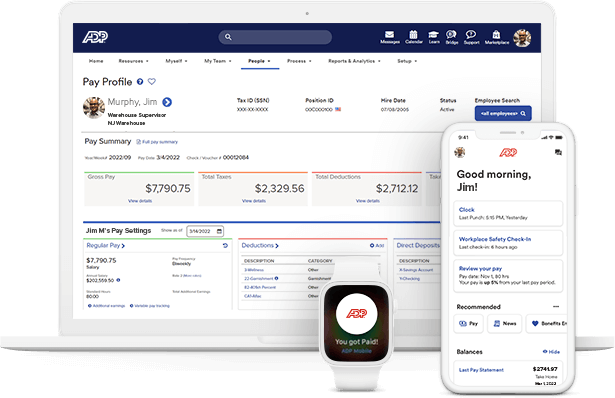

Learn more about ADP Workforce Now

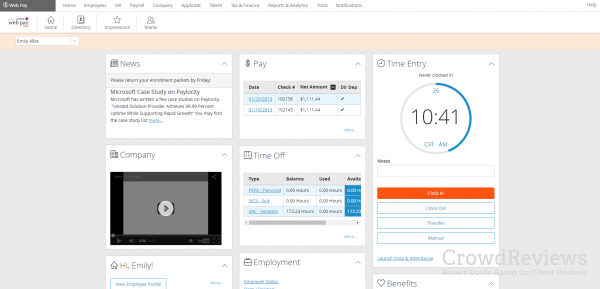

Image Gallery

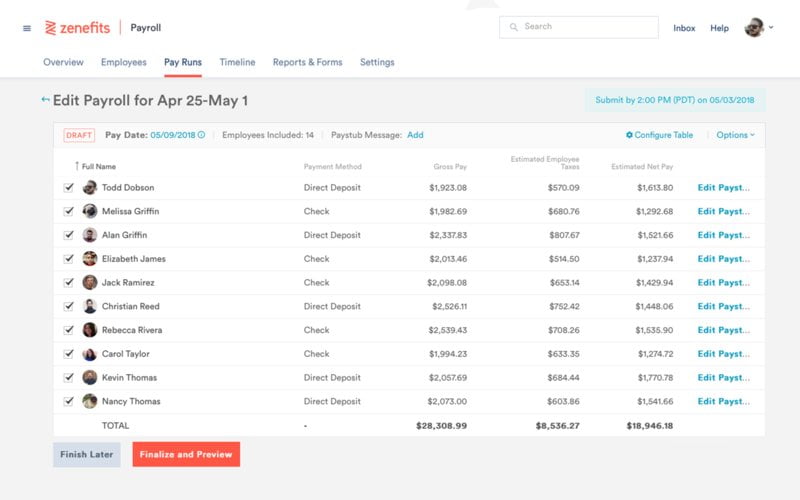

4. Zenefits

Introduction

Zenefits is an all-in-one HR and payroll software solution designed for SMBs. It offers a range of features, including payroll processing, benefits administration, and time-off tracking.

Key features

- Payroll processing with automated calculations and tax filings

- Benefits administration and open enrollment management

- Time-off tracking and absence management

- Compliance assistance and reporting tools

- Employee self-service portal for accessing pay stubs and tax documents

Pricing

Zenefits offers three pricing plans:

- Essentials: Starting at $8 per employee per month

- Growth: Starting at $14 per employee per month

- Zen: Custom pricing based on business requirements

Pros

- all-in-one HR and payroll solution

- user-friendly interface and intuitive design

- Comprehensive compliance assistance and reporting tools

- Integration with popular accounting and time-tracking software

Cons

- Custom pricing is required for the Zen plan.

- Limited customization options for payroll and reporting

Get a free quote

Zenefits offers an all-in-one HR and payroll solution. Click below for a free quote and see how Zenefits can make HR and payroll a breeze.

Learn more about Zenefits

Image Gallery

5. BambooHR

Introduction

BambooHR is an HR software solution that includes payroll processing as one of its features. It focuses on providing a user-friendly interface and tools for employee management.

Key features

- Payroll processing with automated calculations and tax filings

- Employee data management, including onboarding and offboarding

- Time-off tracking and absence management

- Customizable reporting and analytics

- Integration options with popular accounting software

Pricing

BambooHR offers custom pricing based on the number of employees and business requirements. Contact BambooHR for a personalized quote.

Pros

- user-friendly interface and intuitive design

- Comprehensive employee management features

- Customizable reporting and analytics

- Integration options with popular accounting software

Cons

- Pricing information is not readily available.

- Limited payroll-specific features compared to dedicated payroll software

Get a free quote

BambooHR combines user-friendly HR tools with efficient payroll processing. Contact BambooHR for a personalized quote and elevate your HR experience.

Learn more about BambooHR

Image Gallery

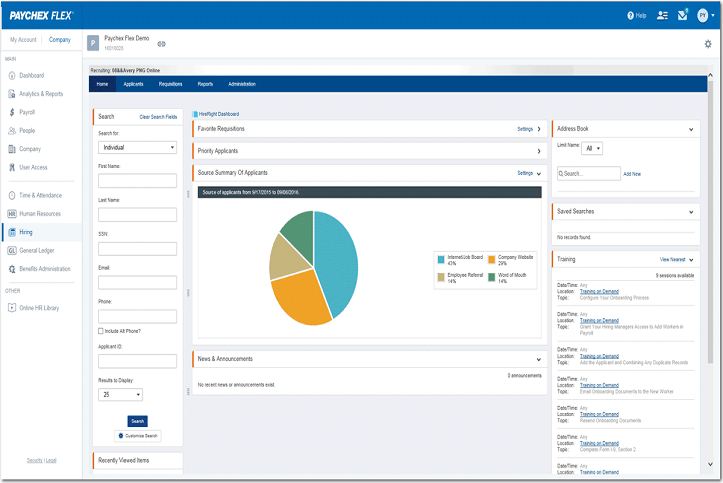

6. Paychex Flex

Introduction

Paychex Flex is a comprehensive payroll and HR software solution designed for businesses of all sizes. It offers a range of features, including payroll processing, benefits administration, and time and attendance tracking.

Key features

- Payroll processing with automated calculations and tax filings

- Benefits administration and open enrollment management

- Time and attendance tracking with customizable rules and policies

- HR features, including onboarding and employee self-service

- Compliance assistance and reporting tools

Pricing

Pricing for Paychex Flex is not publicly available. Contact Paychex for a custom quote based on your business requirements.

Pros

- Comprehensive payroll and HR features on a single platform

- A scalable solution suitable for businesses of all sizes

- Integration options with popular accounting software

- Comprehensive compliance assistance and reporting tools

Cons

- Pricing information is not readily available.

- Some users report a steep learning curve.

Get a free quote

Looking for a comprehensive payroll solution? Get in touch with Paychex Flex for a custom quote and explore their extensive HR features.

Learn more about Paychex Flex

Image Gallery

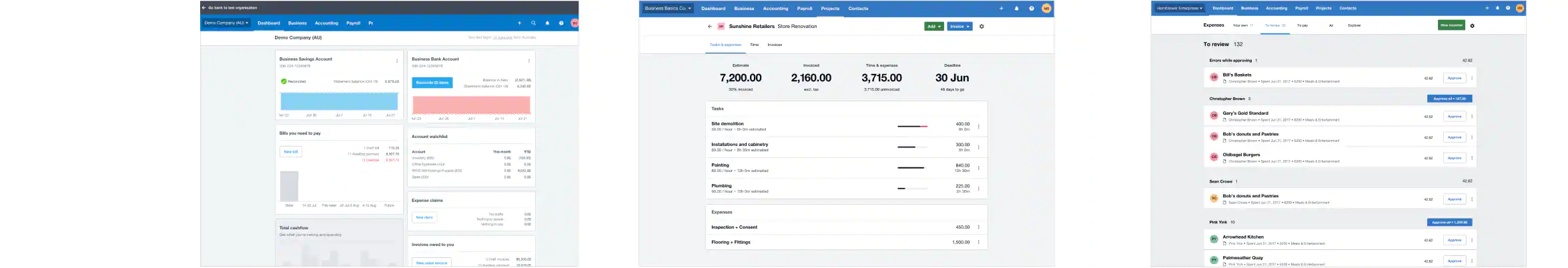

7. Xero

Introduction

Xero is a cloud-based accounting software that includes payroll as one of its features. It offers a range of accounting and bookkeeping tools in addition to payroll processing.

Key features

- Payroll processing with automated calculations and tax filings

- Time and attendance tracking

- Integration with popular accounting and time-tracking software

- Employee self-service portal for accessing pay stubs and tax documents

- Customizable reporting and analytics

Pricing

Xero offers three pricing plans, with payroll included:

- Early: Starting at $11 per month, plus $4 per employee per month

- Growing: Starting at $32 per month, plus $4 per employee per month

- Established: Starting at $62 per month, plus $4 per employee per month

Pros

- Seamless integration with Xero accounting software

- user-friendly interface and intuitive design

- Comprehensive reporting and analytics

- Integration options with popular accounting and time-tracking software

Cons

- Limited payroll-specific features compared to dedicated payroll software

- Some users report occasional system glitches.

Get a free quote

Xero seamlessly integrates payroll with accounting. Click below for a free quote and discover the convenience of Xero for your payroll needs.

Learn more about Xero

Image Gallery

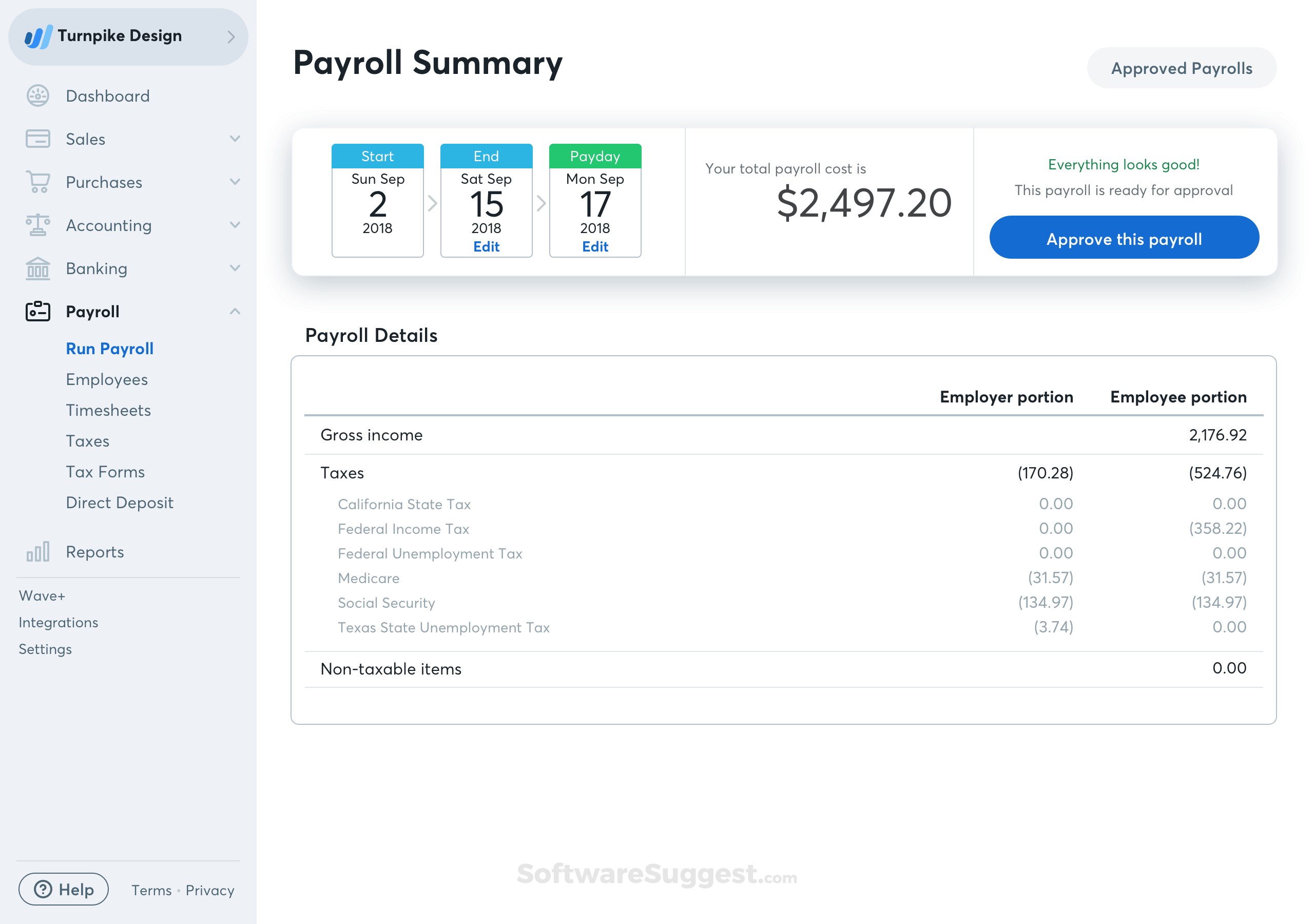

8. Wave Payroll

Introduction

Wave Payroll is a free payroll software solution aimed at small businesses with fewer than 10 employees. It offers basic payroll features, including automated calculations and tax filings.

Key features

- Basic payroll processing with automated calculations and tax filings

- Employee self-service portal for accessing pay stubs and tax documents

- Integration with Wave's accounting software and invoicing tools

- Mobile app for on-the-go payroll management

Pricing

Wave Payroll is free to use, with certain limitations. Additional features, such as direct deposit and time-tracking integration, are available for a fee.

Pros

- Free payroll software for small businesses

- user-friendly interface and straightforward setup process

- Integration with Wave's accounting software and invoicing tools

- Mobile app for easy on-the-go payroll management

Cons

- limited features compared to paid payroll software

- Additional fees for certain advanced features

Get a free quote

Wave Payroll offers a free, basic payroll solution for small businesses. Visit below for more information and to explore their advanced features.

Learn more about Wave Payroll

Image Gallery

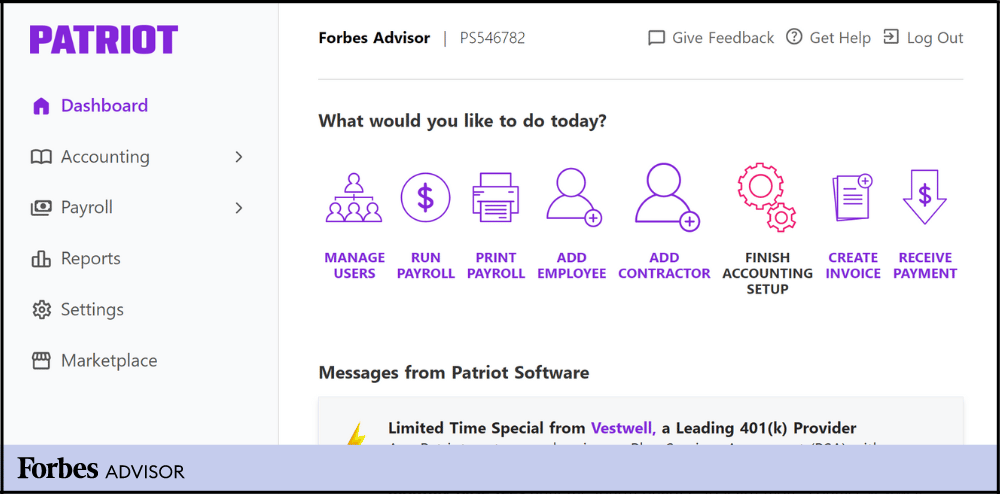

9. Patriot Software

Introduction

Patriot Software offers a comprehensive payroll software solution for small businesses. It focuses on affordability and ease of use, making it an attractive option for SMBs.

Key features

- Payroll processing with automated calculations and tax filings

- Employee self-service portal for accessing pay stubs and tax documents

- Time and attendance tracking with customizable rules and policies

- Integration with popular accounting and time-tracking software

- Customizable reporting and analytics

Pricing

Patriot Software offers two pricing plans:

- Basic Payroll: Starting at $10 per month, plus $4 per employee per month

- Full-Service Payroll: Starting at $30 per month, plus $4 per employee per month

Pros

- Affordable payroll software for small businesses

- user-friendly interface and straightforward setup process

- Integration options with popular accounting and time-tracking software

- Customizable reporting and analytics

Cons

- Some users report occasional system glitches.

- Limited customization options for payroll and reporting

Get a free quote

Patriot Software provides an affordable payroll solution for small businesses. Get a free quote today and streamline your payroll process.

Learn more about Patriot Software

Image Gallery

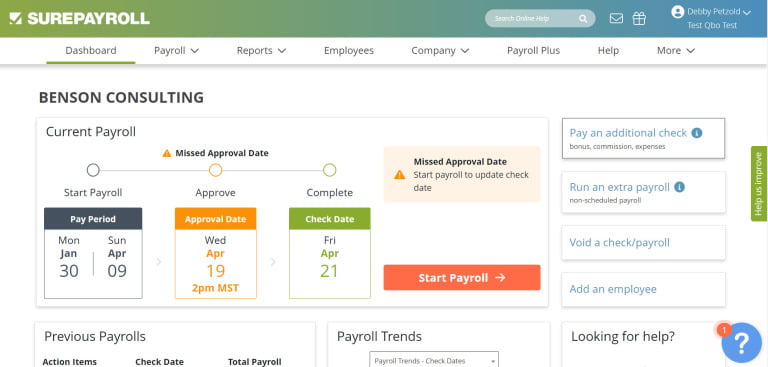

10. SurePayroll

Introduction

SurePayroll is a cloud-based payroll software solution designed for small businesses. It offers a range of features, including payroll processing, tax filings, and time-off tracking.

Key features

- Payroll processing with automated calculations and tax filings

- Time-off tracking and absence management

- Integration with popular accounting and time-tracking software

- Employee self-service portal for accessing pay stubs and tax documents

- Comprehensive compliance assistance and reporting tools

Pricing

SurePayroll offers custom pricing based on the number of employees and business requirements. Contact SurePayroll for a personalized quote.

Pros

- user-friendly interface and intuitive design

- Comprehensive compliance assistance and reporting tools

- Integration options with popular accounting and time-tracking software

- Employee self-service portal for accessing pay stubs and tax documents

Cons

- Pricing information is not readily available.

- Some users report occasional system glitches.

Get a free quote

SurePayroll tailors its services to small businesses. Contact them for a personalized quote and experience hassle-free payroll management.

Learn more about SurePayroll

Image Gallery

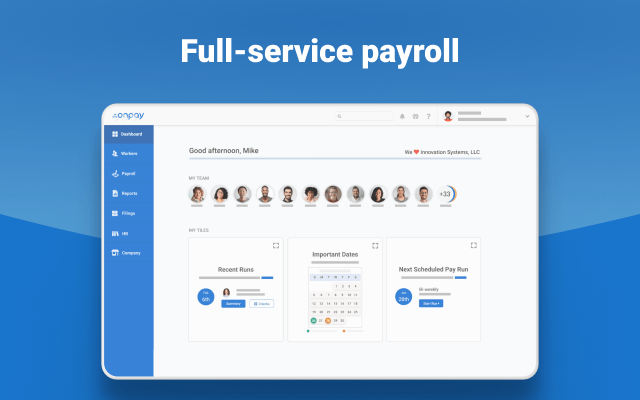

11. OnPay

Introduction

OnPay is a payroll software solution designed for small businesses. It offers a range of features, including payroll processing, tax filings, and benefits administration.

Key features

- Payroll processing with automated calculations and tax filings

- Benefits administration and open enrollment management

- Time and attendance tracking with customizable rules and policies

- HR features, including onboarding and employee self-service

- Comprehensive compliance assistance and reporting tools

Pricing

OnPay offers custom pricing based on the number of employees and business requirements. Contact OnPay for a personalized quote.

Pros

- user-friendly interface and intuitive design

- Comprehensive payroll and HR features

- Integration options with popular accounting software

- Comprehensive compliance assistance and reporting tools

Cons

- Pricing information is not readily available.

- Some users report occasional system glitches.

Get a free quote

OnPay delivers comprehensive payroll and HR features. Get in touch for a custom quote and see how OnPay can meet your business needs.

Learn more about OnPay

Image Gallery

12. Square Payroll

Introduction

Square Payroll is a payroll software solution designed for small businesses. It offers a range of features, including payroll processing, tax filings, and time and attendance tracking.

Key features

- Payroll processing with automated calculations and tax filings

- Time and attendance tracking with customizable rules and policies

- Integration with Square's point-of-sale and payment processing tools

- Employee self-service portal for accessing pay stubs and tax documents

- Comprehensive compliance assistance and reporting tools

Pricing

Square Payroll offers two pricing plans:

- Core Payroll: Starting at $29 per month, plus $5 per employee per month

- Premium Payroll: Starting at $49 per month, plus $5 per employee per month

Pros

- Integration with Square's point-of-sale and payment processing tools

- user-friendly interface and straightforward setup process

- Time and attendance tracking with customizable rules

- Comprehensive compliance assistance and reporting tools

Cons

- Limited customization options for payroll and reporting

- Additional fees for certain advanced features

Get a free quote

Integrate your payroll with Square's tools. Click below for a free quote from Square Payroll and simplify your payroll process.

Learn more about Square Payroll

Image Gallery

13. Wagepoint

Introduction

Wagepoint is a payroll software solution designed for small businesses. It offers a range of features, including payroll processing, tax filings, and time and attendance tracking.

Key features

- Payroll processing with automated calculations and tax filings

- Time and attendance tracking with customizable rules and policies

- Integration with popular accounting and time-tracking software

- Employee self-service portal for accessing pay stubs and tax documents

- Comprehensive compliance assistance and reporting tools

Pricing

Wagepoint offers two pricing plans:

- Essentials: $20 base fee per month, plus $2.50 per employee per month

- Complete: $35 base fee per month, plus $4.50 per employee per month

Pros

- user-friendly interface and intuitive design

- Comprehensive compliance assistance and reporting tools

- Integration options with popular accounting and time-tracking software

- Employee self-service portal for accessing pay stubs and tax documents

Cons

- Limited customization options for payroll and reporting

- Additional fees for certain advanced features

Get a free quote

Wagepoint is designed for small business payroll needs. Visit below for a free quote and explore their user-friendly payroll solutions.

Learn more about Wagepoint

Image Gallery

14. Paylocity

Introduction

Paylocity is a comprehensive payroll and HR software solution designed for mid-sized businesses. It offers a range of features, including payroll processing, benefits administration, and talent management.

Key features

- Payroll processing with automated calculations and tax filings

- Benefits administration and open enrollment management

- Time and attendance tracking with customizable rules and policies

- Talent management features, including performance reviews and goal tracking

- Compliance assistance and reporting tools

Pricing

Pricing for Paylocity is not publicly available. Contact Paylocity for a custom quote based on your business requirements.

Pros

- Comprehensive payroll and HR features on a single platform

- A scalable solution suitable for mid-sized businesses

- Integration options with popular accounting software

- Comprehensive compliance assistance and reporting tools

Cons

- Pricing information is not readily available.

- Steeper learning curve compared to some other software solutions

Get a free quote

Paylocity offers a scalable payroll solution for mid-sized businesses. Contact them for a custom quote and enhance your payroll system.

Learn more about Paylocity

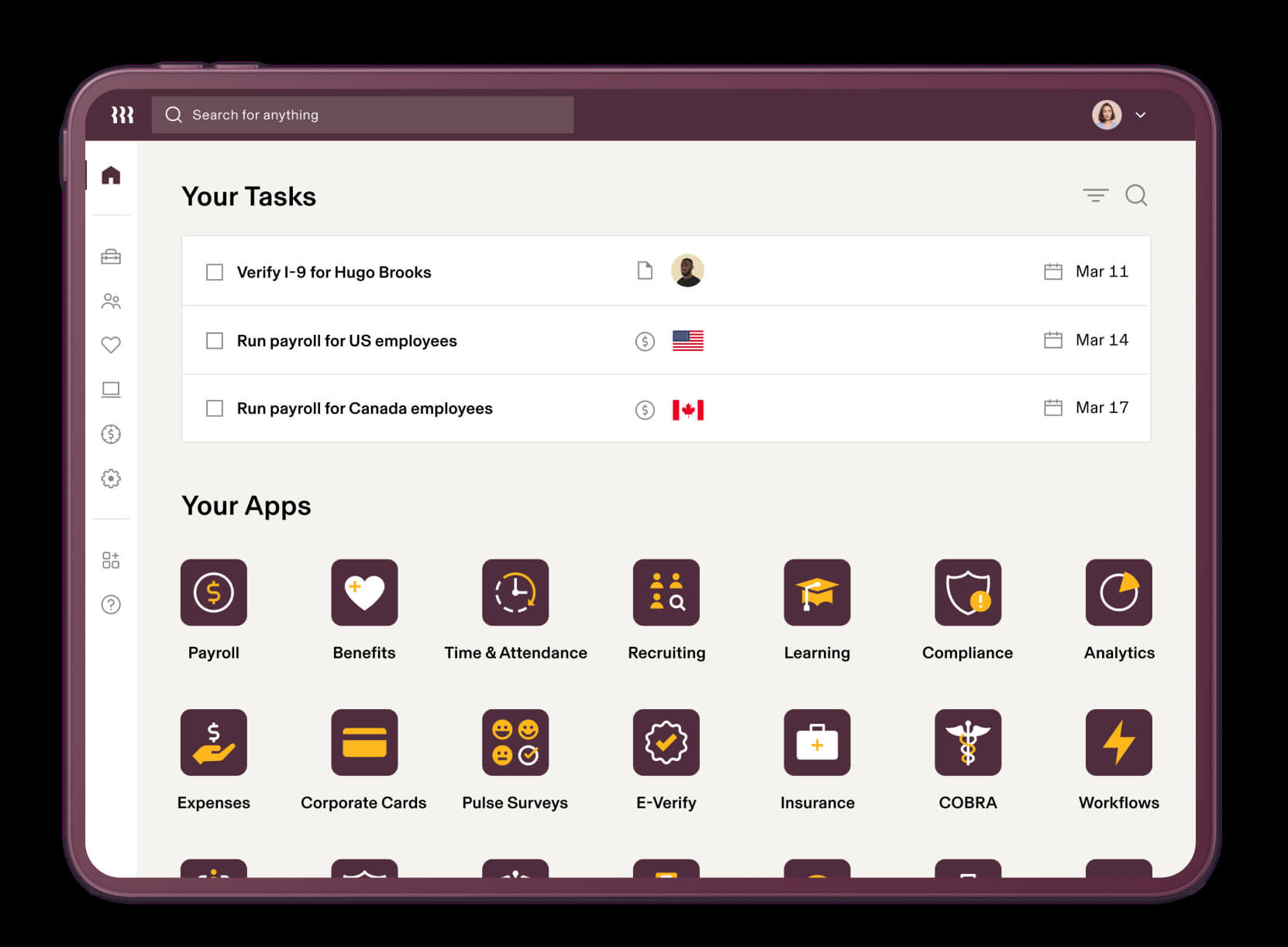

Image Gallery

15. Rippling

Introduction

Rippling is an all-in-one HR and payroll software solution designed for SMBs. It offers a range of features, including payroll processing, benefits administration, and employee management.

Key features

- Payroll processing with automated calculations and tax filings

- Benefits administration and open enrollment management

- Employee data management, including onboarding and offboarding

- Time and attendance tracking with customizable rules and policies

- Comprehensive compliance assistance and reporting tools

Pricing

Rippling offers custom pricing based on the number of employees and business requirements. Contact Rippling for a personalized quote.

Pros

- all-in-one HR and payroll solution

- user-friendly interface and intuitive design

- Comprehensive compliance assistance and reporting tools

- Integration options with popular accounting and time-tracking software

Cons

- Pricing information is not readily available.

- Limited customization options for payroll and reporting

Get a free quote

Rippling provides an all-in-one HR and payroll solution. Get a personalized quote by contacting Rippling and streamline your HR processes.

Learn more about Rippling

Image Gallery

Conclusion

Selecting the right payroll software for your SMB can significantly improve HR and payroll efficiency while ensuring compliance with tax regulations and labor laws. The top 15 payroll software solutions discussed in this article offer a range of features and pricing options to meet the needs of SMBs. Whether you prioritize scalability, customization, cost-effectiveness, user-friendliness, or compliance features, there is a payroll software solution on this list that can streamline your HR and payroll processes. Take the time to explore these solutions, request free quotes, and make an informed decision that aligns with your business goals. By investing in the right payroll software, you can save time, reduce errors, and focus on growing your business.

Topics

Bharath Kumar

Senior Microsoft 365 Consultant • 8+ years

Bharath is a Senior Microsoft 365 Consultant specializing in enterprise productivity solutions and white-label IT services. He has successfully deployed Microsoft 365 for over 200 organizations and helps MSPs build scalable white-label partnerships.